According to a report by McKinsey, executives spend on average 37 per cent of their time making decisions, but they think most of this time is ineffectively spent.

Does this figure hold true for startups? No one can say for sure. But there is no need to conduct another survey to say optimising decision-making efforts is critical, isn’t it?

So, below are the cherry-picked tips that founders can leverage to make decision-making time more effective. These are here because competent people like Andy Grove and Ray Dalio have used them, and yes, I’m intentionally biased toward proven advice.

You can call them tips from decision-making practitioners or tablets for the fear of missing out — how do others decide? A summary is provided at the end of this post.

Andy Grove, High Output Management

Managerial processes, decision-making is likelier to generate high-quality output in a timely fashion if we say clearly at the outset that we expect exactly that …

- What decision needs to be made?

- When does it have to be made?

- Who will decide?

- Who will need to be consulted prior to making the decision?

- Who will ratify or veto the decision?

- Who will need to be informed of the decision?

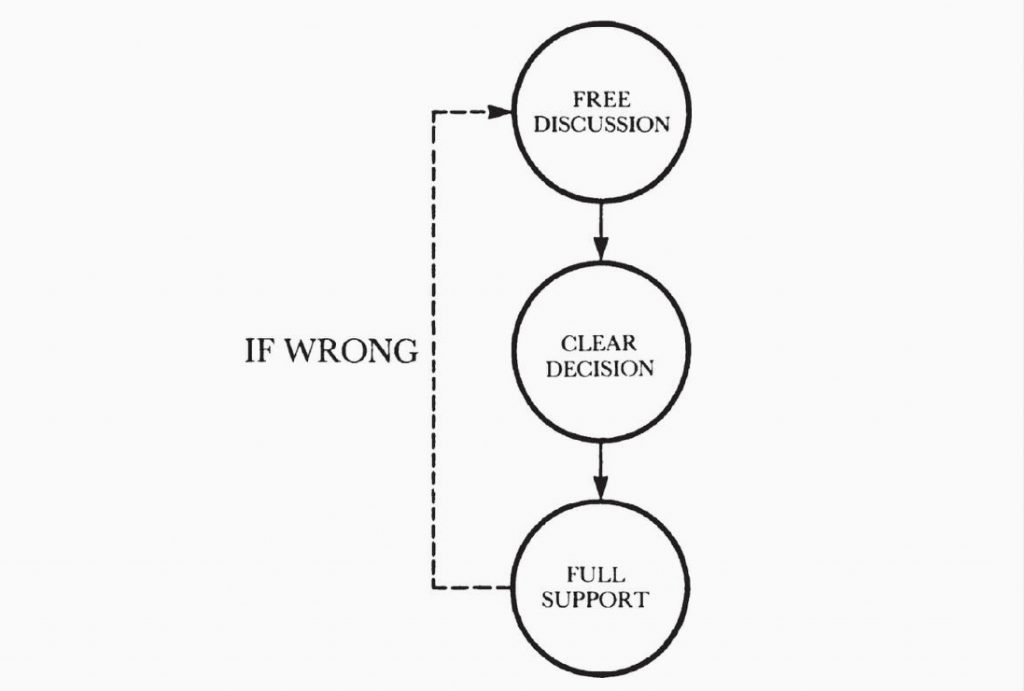

Free discussion

All points of view and all aspects of an issue are openly welcomed and debated. The greater the disagreement and controversy, the more important becomes the word free.

It is very important that everybody there voice opinions and beliefs as equals throughout the free discussion stage, forgetting or ignoring status differentials (page 1531).

Clear decision

The greater the disagreement about the issue, the more important becomes the word clear. In fact, particular pains should be taken to frame the terms of the decision with utter clarity.

Again, our tendency is to do just the opposite: when we know a decision is controversial we want to obscure matters to avoid an argument. But the argument is not avoided by our being mealy-mouthed, merely postponed. People who don’t like a decision will be a lot madder if they don’t get a prompt and straight story about it.

Full support

This does not necessarily mean agreement: so long as the participants commit to back the decision, that is a satisfactory outcome.

… An organization does not live by its members agreeing with one another at all times about everything. It lives instead by people committing to support the decisions and the moves of the business. All a manager can expect is that the commitment to support is honestly present, and this is something he can and must get from everyone.

Anybody who makes a business decision also possesses emotions such as pride, ambition, fear, and insecurity [e.g. the peer-group syndrome, the fear of simply sounding dumb, the fear of being overruled]

Solutions

1. Peer-plus-one approach

2. Realize that nobody has ever died from making a wrong business decision, or taking inappropriate action, or being overruled. And everyone in your operation should be made to understand this.

3. We are all human beings endowed with intelligence and blessed with willpower. Both can be drawn upon to help us overcome our fear of sounding dumb or of being overruled, and lead us to initiate discussion and come out front with a stand.

(The above info is cut from many pages of the High Output Management book.)

Jeff Bezos, Amazon Annual Shareholder Letter 2016 and 2017

“Some decisions are consequential and irreversible or nearly irreversible – one-way doors – and these decisions must be made methodically, carefully, slowly, with great deliberation and consultation”

— Jeff Bezos, 2016 Letter to Shareholders

“Never use a one-size-fits-all decision-making process …

Most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you’re probably being slow. Plus, either way, you need to be good at quickly recognizing and correcting bad decisions. If you’re good at course correcting, being wrong may be less costly than you think, whereas being slow is going to be expensive for sure.

– Jeff Bezos, Letter to the shareholder (2017)

“Use the phrase “disagree and commit.” This phrase will save a lot of time. If you have conviction on a particular direction even though there’s no consensus, it’s helpful to say, “Look, I know we disagree on this but will you gamble with me on it? Disagree and commit?” By the time you’re at this point, no one can know the answer for sure, and you’ll probably get a quick yes. This isn’t one way. If you’re the boss, you should do this too …”

— Jeff Bezos, 2017 Letter to Shareholders

Sometimes teams have different objectives and fundamentally different views. They are not aligned. No amount of discussion, no number of meetings will resolve that deep misalignment. Without escalation, the default dispute resolution mechanism for this scenario is exhaustion. Whoever has more stamina carries the decision …”

— Jeff Bezos, 2017 Letter to Shareholders

Patrick Collison, FS podcast

If you can make twice as many decisions at half the precision, that’s often better. The improving of decision-making with additional time often flattens out.

I think most people should be operating earlier in that curve. Make more decisions with less confidence but in significantly less time. In most cases you can course correct. Fast decisions are an asset and a capability in their own right.

- Who will ratify or veto the decision?

- Who will need to be informed of the decision?

Those with low reversibility and high magnitude you can spend a lot of time on, in the other 3 quadrants you can be much more flexible and fluid.

Why is the CEO making the decision? Sometimes if I have to make the decisions it means something else in the organisation is broken. Pushing others who are the domain experts to make more decisions.

Currently, at Stripe we’re getting different parts of the organisation to write down what they’re optimising for: what their mission is, what the long-term key metrics are for their part of the organisation, who their customers are both internally and externally.

Once there’s that agreement on those longer-term things, then maybe a difference on any particular decision might just be that we differ on what the most instrumentally effective way to achieve this outcome is, but we know we’re unified on what the desired end state is. That way you can quickly test who is right/wrong.

The more troubling ones are where there’s more latent disagreement on what you’re actually optimising for but that’s never explicitly surfaced or uncovered. Now in decision-making, I place more importance on making sure we have the right foundational agreement so that the kinds of disagreement that tend to arise are of the more superficial sort and where agreement is actually less important.

Whatever success I’ve had has been more due to my knowing how to deal with what I don’t know than anything I know …

Know all the possibilities, think about the worst-case scenarios, and then find ways to eliminate the intolerable ones.

Identifying and eliminating the intolerable worst-case scenarios comes first. That’s because the most important thing in playing the game (of life or the markets) is to not get knocked out of it …

In addition to making sure I’ve covered all the worst-case scenarios I can think of, I try to cover those I can’t think of by diversifying well. I learned the math of it and I’m drawn to it instinctively.

Essentially, if I have a bunch of bets that are attractive but unrelated, I can reduce my risks by up to 80% without reducing my upside at all. While this sounds like an investment strategy, it’s actually an old and well-established good life strategy that I apply to investments as well.

There is a Chinese saying that “a smart rabbit has three burrows,” meaning three places to go to in case any one of them becomes dangerous. This principle has saved many people’s lives when things got bad, and it’s one of my most important principle.

Put deferred gratification ahead of immediate gratification so you will be better off in the future.

I tag along with the smartest people I can find, so I can stress test my thinking and learn from them.

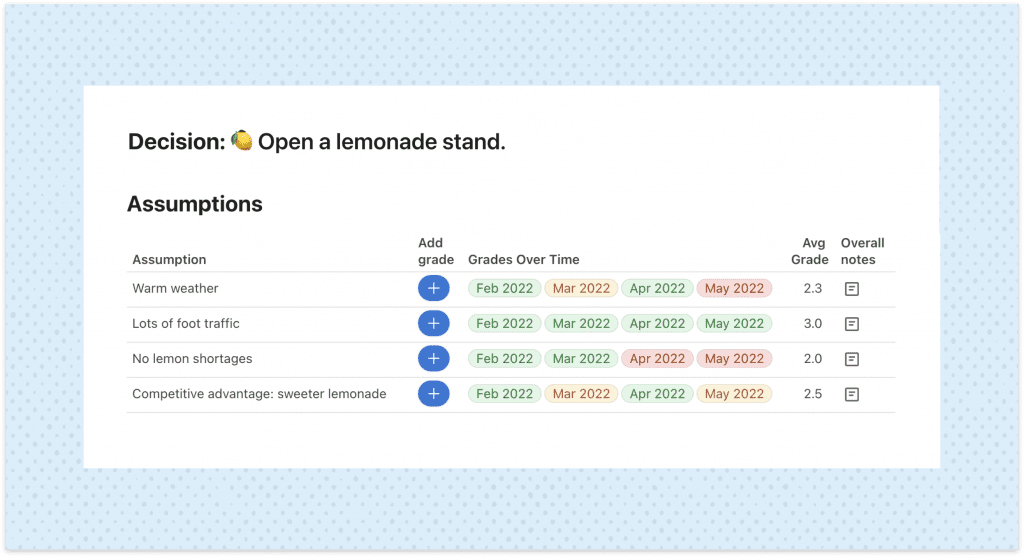

Fidji Simo, Assumption Report Card

… Think of the concept of “garbage in, garbage out” — if the data you use for analyses is bad, then your conclusions are bad; the same goes for decisions – the wrong assumptions result in the wrong decisions.

Based on this idea, I started tracking my assumptions for big strategic decisions, usually along four big axes: assumptions on evolution of consumer needs, technological changes, overall business landscape, and competition. Then I would rate these assumptions on a scale of 1-3 – where 1 totally missed the mark, 2 is in the ballpark but with some nuance, and 3 is right on target.

In addition to making sure I’ve covered all the worst-case scenarios I can think of, I try to cover those I can’t think of by diversifying well. I learned the math of it and I’m drawn to it instinctively.

Essentially, if I have a bunch of bets that are attractive but unrelated, I can reduce my risks by up to 80% without reducing my upside at all. While this sounds like an investment strategy, it’s actually an old and well-established good life strategy that I apply to investments as well.

There is a Chinese saying that “a smart rabbit has three burrows,” meaning three places to go to in case any one of them becomes dangerous. This principle has saved many people’s lives when things got bad, and it’s one of my most important principle.

Over time, you will want to ask yourself:

- What are the types of assumptions that you systematically get right? That way, you can more confidently and heavily bet on your judgment on these.

- What are the types of assumptions that you systematically get wrong? For these, you will know to take more time to educate yourself on the landscape, ask for more diverse opinions, and pause longer before deciding on a course of action.

- For assumptions that you initially got right, then turned out to be wrong longer-term, what changed? Did you react fast enough to the change and adjust your decisions accordingly? How can you more rapidly recognize when core assumptions have been challenged, and require a change in past decisions?

- How can you include these reflections in a team postmortem, so the whole team can learn about their own decision-making process?

A toolkit for your Assumption Report Card

Brian Armstrong, Jack Altman, Sriram Krishna, Phil Libin

Brian Armstrong, How we make decisions at Coinbase

If there is any data gathered from customers, split tests, the legal team, outside consultants, etc, now is the time to present it the group. Ideally these are shared as pre-reads in advance of the meeting to deliberate.

Jack Altman, Tweet

The best decisions tend to be made in isolation after lots of one on one conversations and lots of quiet thinking. Not in group decision-making formats with lots of google docs and team meetings.

Sriram Krishna, Tweet

Thought experiment I suggested to a friend: major platform companies document their decision making process around major policy decisions. Live stream internal meetings, publish the artifacts.

Ideally see SCOTUS decision-style documentation (arguments made, dissent, etc) on these decisions as they are made.

If we believe these decisions are consequential (which I think we all do), it stands to reason the public gets to see how they are made.

Phil Libin, Be Epic: The Art of Bold Decision Making

When you compare positive to negative, what you really wind up doing is letting the negatives dominate and you wind up saying, “That guy’s the choice because he’s the least bad,” not because he’s the least good …

If, on the other hand, you’re making long-term decisions, you’re making decisions that aren’t about survival second to second but are about what kind of product you should make? What should the name of your company be? Who do you want to get married to?

Decisions that are long-term and that are hopefully based on positive outcomes, you can’t make them in this style. You have to turn off the lizard brain. You have to supress the lizard brain as much as possible. The way you do that, there are lots of techniques but the basic one is you just force yourself to do it. You just basically don’t look at the negatives, you only look at the positives.

So, above are the tips. I want to add 3 more points to the list

Make sure you are calm when making decisions: Your mood and your team‘s mood matter greatly. Calm minds have more clarity thus guiding higher-quality decisions. So, always be aware of your mind’s state and just decide when your mind is crystal clear. You can use meditation, exercise, etc. to change the state of mind immediately.

Examples:

- Use this box breathing technique to be calmer after a few breaths: breathe in 4 seconds (count 1,2,3,4), hold for 4 seconds, breathe out for 8 seconds.

- Run or do any kind of exercise that makes you sweat and feel fresh.

- Take a couple of minutes to do yoga for your brain (alternate nostril breathing).

Decisions are made from data. The better data, the better decisions. Check this post for more information about those biases as well as other mental models that can be helpful to make calls.

Suggested Decision Making Checklist

1. What type of decision are we going to make? What is the goal?

Strive for the output by settling six important questions in advance

Distinguish reversible and irreversible decisions/ Consider the degree of reversibility and magnitude

2. What data do we need? Do we have enough of it?

Share data in advance

Triangle among the smartest people to stress test the thinking

Have lots of one on one conversations and lots of quiet thinking

Decide when having around 70% of the info

Be aware of your own bias when searching for data

3. Are we having our principles in place?

Recognize true misalignment issues early and escalate them immediately

Make sure we have the right foundational agreement

Place more value on decision speed

Disagree and Commit/ full support

Try to make fewer decisions

Find ways to eliminate the intolerable scenarios

Diversify well

Put deferred gratification ahead of immediate gratification

Make sure to check if you are calm when making decisions

Ask important reflection questions

4. Do we need to use frameworks this time? If yes, what are the frameworks we want to use?

Score assumptions, not decisions; look back your scores regularly and adjust them

Don’t look at the negatives, look at the positives to decide

Your frameworks